ADA Price Prediction: Technical Breakout Imminent as Whales Accumulate

#ADA

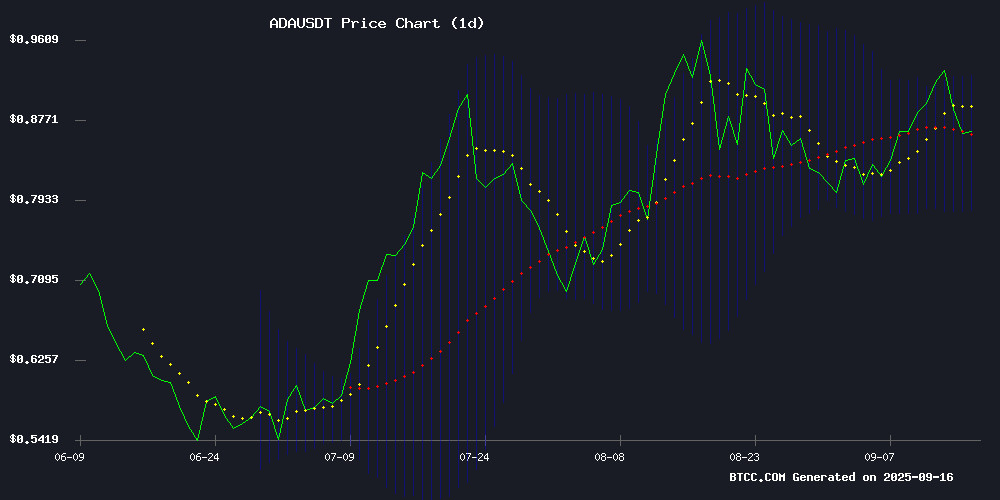

- ADA trading above 20-day MA indicates underlying bullish momentum

- Whale accumulation patterns contrast with retail profit-taking, suggesting institutional confidence

- Strategic regulatory engagement and technical positioning support potential breakout toward $0.92-0.95 resistance

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

ADA is currently trading at $0.8639, positioned above its 20-day moving average of $0.85276, indicating underlying strength. The MACD reading of -0.018997 suggests some near-term bearish momentum, though the histogram shows potential for reversal. Bollinger Bands indicate ADA is trading closer to the middle band, with resistance at $0.9234 and support at $0.7821. According to BTCC financial analyst Olivia, 'The price holding above the 20-day MA while whales accumulate suggests institutional confidence despite retail profit-taking.'

Market Sentiment: Strategic Developments Drive Positive Outlook

Recent developments including Charles Hoskinson's strategic visit to Washington DC and whale accumulation patterns are creating positive sentiment around ADA. While retail investors are taking profits, institutional players appear to be building positions. BTCC financial analyst Olivia notes, 'The combination of strategic regulatory engagement and whale accumulation typically precedes significant price movements. The current market structure suggests cautious Optimism among larger investors.'

Factors Influencing ADA's Price

Cardano Price Analysis: Key Levels to Watch in Coming Days

Cardano's ADA has been consolidating between $0.87-$0.90 after rebounding from a weekly low near $0.85. Trading volume remains steady but unspectacular, reflecting cautious market participation rather than strong conviction. The token faces immediate resistance at $0.95, with traders questioning whether it can challenge the psychological $1.00 barrier this month.

Technical indicators paint a mixed picture. While the MACD shows bearish divergence, the RSI maintains bullish positioning in upper bands. The price action suggests formation of another higher low within a rising wedge pattern—a potential accumulation opportunity for investors. Bollinger Band compression indicates impending volatility, with the wedge's support test becoming increasingly critical.

Market structure remains nominally bullish with consecutive higher highs since July, though failure to hold pivotal resistance levels has triggered corrective movements. A decisive break above $0.95 could open path to $1.10-$1.20, while rejection may see retest of $0.85 support.

Charles Hoskinson Prepares for Another Strategic Visit to Washington, DC

Charles Hoskinson, CEO of Input Output Global (IOG), is returning to Washington, DC, for high-stakes discussions with lawmakers and regulators. The visit underscores his persistent advocacy for clear crypto policies and Cardano's integration into U.S. financial systems. Hoskinson's agenda includes private meetings with senators and testimony on blockchain's transformative potential.

This marks his latest effort to shape regulatory frameworks since his 2022 congressional testimony. His approach combines technical expertise with political pragmatism, positioning Cardano as a solution for market efficiency and transparency. The timing coincides with growing institutional interest in proof-of-stake networks and decentralized governance models.

Cardano (ADA) Price: Whales Accumulate Amid Retail Profit-Taking

Cardano's ADA faces a 7% correction to $0.85-$0.90 as retail investors cash out gains, while whales seize the opportunity to accumulate 20 million tokens in a single day. The cryptocurrency's market structure shows resilience, with consistent buying support near $0.86.

Technical indicators point to critical support at $0.82, with a breakout above $0.95 potentially propelling ADA toward $1.15-$1.25 targets. The long-to-short ratio dropping to 0.87 reflects bearish sentiment among traders, contrasting sharply with institutional accumulation patterns.

Market capitalization holds steady at $33 billion despite the pullback, demonstrating ADA's ability to maintain value after its recent climb from $0.86 to $0.93. The divergence between whale accumulation and retail profit-taking suggests a potential power shift in market dynamics.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, ADA shows potential for upward movement toward the $0.92-$0.95 resistance zone in the coming weeks. The combination of whale accumulation, strategic industry developments, and technical positioning above key moving averages suggests bullish momentum building.

| Target Level | Probability | Timeframe |

|---|---|---|

| $0.92-0.95 | High | 2-3 weeks |

| $1.00-1.05 | Medium | 4-6 weeks |

| $0.78-0.82 | Low (Support) | Any downside movement |